Union bank of india account transfer application form pdf download

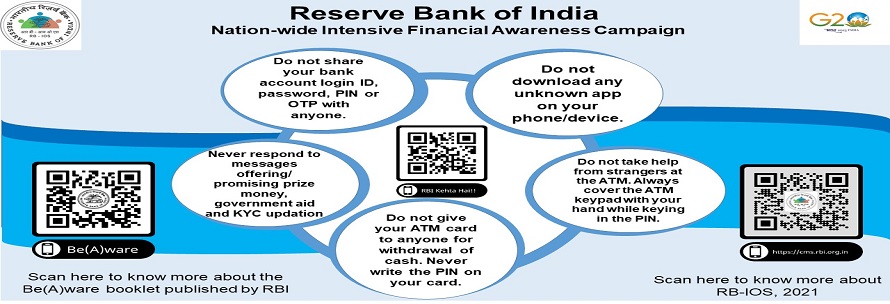

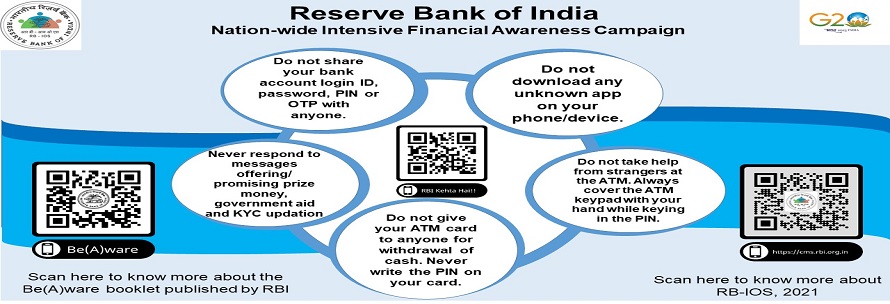

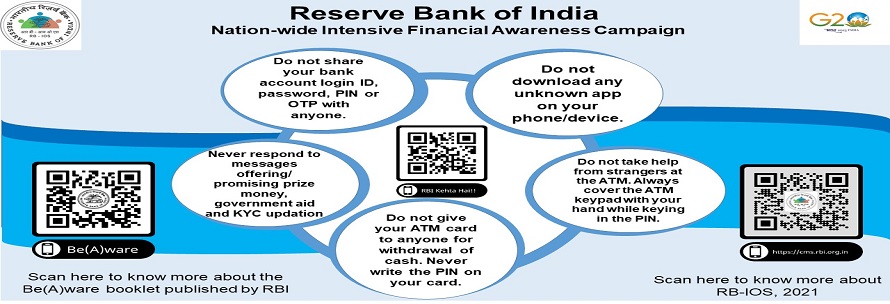

Salient features of RBI" />

Salient features of RBI" />

- Know Your User-ID

- Retail User Login

- Corporate User Login

- Self User Creation

- Forgot/Create Password

- Password Creation Process[pdf]

Register for Mobile Banking Download the Vyom App from Google Playstore/ iOS App store and proceed for registration through Internet Banking / Debit Card/ Branch Token

Due to maintenance activity, ATM/Debit Card services may fluctuate intermittently between 01:00 AM to 02:00 AM on 31.08.2024 and 01.09.2024.

Dear Customers,we are now live for custom duty payment through ICEGATE ECL 2.0. Users can use this facility to make indirect tax payments.

The new IFSC can be obtained by sending SMS to '09223008486' by typing 'IFSC '. The new IFSC codes are also available on Union Bank of India website under Amalgamation Centre.

Quick Links!

- RBI Limited Liability Policy

- Agri Advisory Services

- Value Chain Finance

- Apply for LC/BG/Forex remittance

- Apply for POS

- Avail Pre-Approved Credit Card

- Union Bank FastTag Recharge

- Apply for General Insurance

- Branch/ATM Locator

- DigiLocker

- DigiSaathi-Helpline 24*7

- Door Step Banking

- Generate CIBIL Score

- Government Schemes

- Grievances Online

- Procedure to Lodging the Grievance

- Instant Personal Loan

- Kisan Vikas Patra

- NPS

- Online Account Opening

- Online Loan Application

- Online Nomination

- Open Trading account

- Tokenisation Product Features

- Union e-Tax Payments

- Utility Bill Payments

- View Settlement Calendar E-instruction

- Accessibility

Our Site is digicert secured site. Your credentials travels in a highly secure SSL mode with 128 bit to 256 bit encryption.

The Latest

Based on RBI instructions on amalgamation of Banks, from 1st July 2021 onwards, NEFT/RTGS transactions are not allowed towards IFSC codes of merged banks i.e. Allahabad Bank, Syndicate Bank, Dena Bank and Vijaya Bank. You are requested to register beneficiaries with latest IFSCs of their amalgamated entity.

-->

- Customers are requested to note that old cheque books are being phased out with new ones having additional security features w.e.f. 01.07.2021. Please contact your branch manager for replacement of old cheque book with new cheque book well before the said date. If you have already issued cheque from old cheque book, please get it replaced with new cheque immeditely. On receipt of confirmation from you, Bank will delete the old cheque book records from Core Banking Solution (CBS) system.

- Use NEFT services in place of RTGS while doing fund transfer from Union bank to erstwhile Corporation Bank (eCB).Union Bank and eCB are now treated as same bank for RTGS service and fund transfer within same bank through RTGS is not permitted by RBI. --> You have registered for mandatory additional layer of security, by choosing 3 challenge questions and answering them. In case of providing incorrect answers to the such challenge questions your Internet Banking shall be blocked. In such case, please call our Customer Service at 1800-2222-44 & 1800-208-2244 and choose option no. 2 for further process.

- PSB Alliance Doorstep Banking Services available

- Bank has introduced 3 Factor Authentication (FA) to enhance the security features of your accounts, one time registration for the same is mandatory. Challenge Question Enrollment by user[PDF file].

BEWARE OF FRAUD CALLS

It has been observed that many fake and fraudulent contact numbers are circulated on web posting as ´Banks Customer Care Number´. One such number found in web search is 06206419089. Customers are hereby cautioned to conduct their own investigations and analysis and should check the accuracy, reliability of the contact numbers before using any contact number received by the customer other than through our official channels such as Bank´s Website/authentic literature/Advertisements etc. Bank accepts no responsibility towards any loss incurred by the customer incidental to usage of any unauthentic contact number/channel.

Safe & Secure [Internet Banking Usage Guidelines]

- Access your bank website only by typing the URL in address bar of browser.

- Change your Internet Banking password at regular intervals.

- Immediately change your passwords if you have accidentally revealed your credentials.

- Use Virtual keyboard feature while logging into your internet banking account.

- Always logout when you exit Net Banking.Do not directly close the browser.

- Phishing is a fraudulent attempt,usually made through emails/calls/SMS to capture your confidential data like NetBanking Id/Password, mobile no, email Id /Password,Card no /PIN/CVV no etc.Please report immediately on antiphishing[Dot]ciso[At]the [rate]unionbankofindia[Dot] bank if you receive any such email/SMS or Phone call.

- Be sure the URL you are accessing has 'https://'. The 's' indicates secured and the site uses encryption.

- Always ensure latest version of Operating System with updated security patches.

- Regularly update Browser and Antivirus with latest available definitions.

- Always check the last log-in date and time in the post login page.

- Ensure firewall is on and Antivirus is scanning the system regularly.

- Avoid accessing Internet Banking from Cyber Cafes or shared PCs.

- Check your account statements periodically to ensure that all the entries are correctly captured. In case of any discrepancy, inform the bank immediately

- Never respond to e-mails/embedded links /calls asking you to update or verify UserIDs/Passwords/Card no/CVV etc. Union Bank or any of its representative will never send you e-mails/SMS or calls you over phone to get your confidential details of your account/ PIN/OTP Password or personal details.

- Never enter login or other sensitive information in any pop up window.

- Do not be victim of SIM SWAPS, immediately investigate when you notice that you are not receiving call and message or getting SIM Registration fail. Keep your phone switched on and check alerts from Union Bank of India.

- Never respond to any SIM Swap Request even from mobile operators.

SafeGuard [Beware of phishing]

Avoid fraudulent communications asking for your UserId, Password, Card No, Account No. etc. Fraudulent emails contain links of look-alike websites to capture your financial data. Bank will never send such communications to you asking for your personal/confidential data. Always visit Bank's site instead of clicking on the links provided in emails/third party websites. Do not respond to pop-up windows asking for your financial or confidential information.

- Terms & Conditions

- Disclaimer

Copyright © Union Bank of India, All rights reserved.

Salient features of RBI" />

Salient features of RBI" /> Salient features of RBI" />

Salient features of RBI" />

![]()