Back in May 2023, HSBC launched the TravelOne Card, which brought with it 12 airline and hotel partners (since increased to 20), fee-free instant conversions, four lounge visits per year and a welcome offer of 20,000 bonus miles.

The welcome offer was was originally supposed to lapse on 31 August 2023, but was later extended till 31 December 2023, albeit with a 25% increase in the minimum spending requirement.

The offer has now been extended further till 30 June 2024, and as before, is open to both new and existing HSBC cardholders. However, with the uncertainty surrounding the TravelOne’s proposed new conversion fee, it’s understandable if you’re hesitant to jump onboard.

| |||

| Apply |

Applicants for the HSBC TravelOne Card can choose from two different offers when they apply:

From 1 September 2023 to 30 June 2024, customers who apply for a HSBC TravelOne Card will receive 20,000 bonus miles (in the form of 50,000 HSBC points) when they:

This offer is open to all applicants, regardless of whether or not they currently hold a HSBC credit card. However, if they have cancelled a HSBC TravelOne Card in the past 12 months, they will not be eligible to receive the welcome offer again.

The bonus miles are on top of the base miles that TravelOne Cardholders normally earn, namely:

For example, if you spend the full S$1,000 in local currency, you’ll receive a total of 21,200 miles (20,000 bonus, 1,200 base).

Since the S$196.20 annual fee must be paid, you’re basically paying 0.98 cents per mile.

As an alternative, applicants can choose to receive a first year fee waiver for the HSBC TravelOne Card. If this option is chosen, they will not be eligible for the 20,000 miles welcome gift.

However, they’ll still receive the usual card benefits including four lounge visits per calendar year. Remember, your first membership year will straddle two calendar years, so that’s actually eight free visits at no charge to you.

If this is your plan, I’d recommend applying towards the middle of the year so you’re not so rushed to redeem the second calendar year’s visits. For example:

Cardholders must make a minimum qualifying spend of S$1,000 by the end of the month following card approval.

| Card Account Opening Date | Qualifying Spend Period |

| 1-30 Sep 2023 | 1 Sep to 31 Oct 2023 |

| 1-31 Oct 2023 | 1 Oct to 30 Nov 2023 |

| 1-30 Nov 2023 | 1 Nov to 31 Dec 2023 |

| 1-31 Dec 2023 | 1 Dec to 31 Jan 2024 |

| 1-31 Jan 2024 | 1 Jan to 29 Feb 2024 |

| 1-29 Feb 2024 | 1 Feb to 31 Mar 2024 |

| 1-31 Mar 2024 | 1 Mar to 30 Apr 2024 |

| 1-30 Apr 2024 | 1 Apr to 31 May 2024 |

| 1-31 May 2024 | 1 May to 30 Jun 2024 |

| 1-30 Jun 2024 | 1 Jun to 31 Jul 2024 |

| 1-14 Jul 2024 | 1 Jul to 31 Aug 2024 |

You basically have anywhere between 1-2 months to meet the minimum spend, depending on when your card is approved. Try to get approved early in the month so you have more time to make the minimum spend.

Qualifying spend includes all online and offline retail transactions, excluding the following:

The key exclusions to note here are insurance, utilities, education, government transactions as well as CardUp/ipaymy. These were all excluded from 1 July 2020 onwards as part of HSBC’s revised rewards terms and conditions.

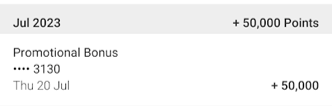

The 20,000 bonus miles will be credited (in the form of HSBC points) within 90 days from the card opening date, provided the eligibility criteria is met.

In my personal experience, I applied in early May and received the bonus points on 20 July 2023.

The terms & conditions of this welcome offer can be found here.

HSBC points earned on the TravelOne Card can be transferred to 20 airline and hotel partners.

| ✈️ HSBC TravelOne Airline Partners | |

| Frequent Flyer Programme | Conversion Ratio (HSBC Points : Partner) |

| 50,000 : 10,000 |

| 40,000 : 10,000 |

| 35,000 : 10,000 | |

| 35,000 : 10,000 |

| 35,000 : 10,000 |

| 35,000 : 10,000 | |

| 30,000 : 10,000 |

| 25,000 : 10,000 |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| | 25,000 : 10,000 |

| 25,000 : 10,000 |

| 25,000 : 10,000 | |

| 25,000 : 10,000 |

| 25,000 : 10,000 | |

| 25,000 : 10,000 |

| 🏨 HSBC TravelOne Hotel Partners | |

| Hotel Programme | Conversion Ratio (HSBC Points : Partner) |

| 30,000 : 10,000 |

| 25,000 : 5,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

Conversions can be done via the HSBC Singapore app (Android | iOS) and are processed instantly, with the exception of the following:

All conversion fees will be waived until 31 May 2024. However, and here’s the kicker, HSBC is proposing an absurdly expensive 10,000 points conversion fee from then on. That’s the equivalent of 4,000 KrisFlyer miles, and based on my value of 1.5 cents per mile, would be hands down the most expensive fee on the market. Put it another way: it’s 20% of your welcome bonus!

If HSBC does not back down on this fee, I can’t see much reason to keep this card…

| |||

| Apply | |||

| Income Req. | S$30,000 p.a. | Points Validity | 3 years |

| Annual Fee (Including GST) | S$196.20 (FYF option) | Min. Transfer | 25,000 points (10,000 miles)^ |

| FCY Fee | 3.25% | Transfer Fee | Free (till 31 May 24) |

| Local Earn | 1.2 mpd | Points Pool? | No |

| FCY Earn | 2.4 mpd | Lounge Access? | Yes: 4x Dragon Pass |

| Special Earn | N/A | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

| ^Subsequently 2 miles | |||

The HSBC TravelOne Card has a minimum income requirement of S$30,000 and an annual fee of S$196.20.

Cardholders will earn 1.2 mpd on all local currency spend, and 2.4 mpd on all foreign currency spend with no minimum spend or caps. Points earned on this card can be transferred to 12 airline and hotel partners, with no transfer fee applicable till 31 May 2024.

Other perks include:

For a full review of this card, refer to the post below.

The HSBC TravelOne Card has extended its 20,000 miles welcome offer till 30 June 2024, with the offer available to both new and existing HSBC cardholders. You will need to pay the first year’s S$196.20 annual fee to enjoy this offer, but should you not wish to do so, a fee waiver option (sans miles) is available.

The bigger question is what HSBC has planned for this card in 2024. Will that ridiculous conversion fee come to pass? Will points pooling finally happen? Will HSBC come up with a bill payment facility of their own, seeing as how they don’t want to play with CardUp and ipaymy?

Watch this space.

Purchases made through any of the links in this article may generate an affiliate commission that supports the running of the site. Found this post useful? Subscribe to our Telegram Channel to get these posts pushed directly to your phone, or our newsletter via the home page.

Aaron founded The Milelion to help people travel better for less and impress chiobu. He was 50% successful.